Cryptocurrencies to watch this week: Binance Coin, Cronos, ZetaChain

Cryptocurrency prices rose modestly during the weekend as investors embraced a risk-on sentiment following Friday’s surge in the US stock market.

Bitcoin (BTC) held steady above $84,000, while the market cap of all coins rose to over $2.8 trillion.

The crypto market will have two main catalysts this week: President Donald Trump’s tariffs and the Federal Reserve’s interest rate decisions. A sign of Trump easing his stand on tariffs and a more dovish Fed will be bullish for cryptocurrencies and other risky assets.

The top cryptocurrencies to watch this week will be Binance Coin (BNB), Cronos (CRO), and ZetaChain (ZETA).

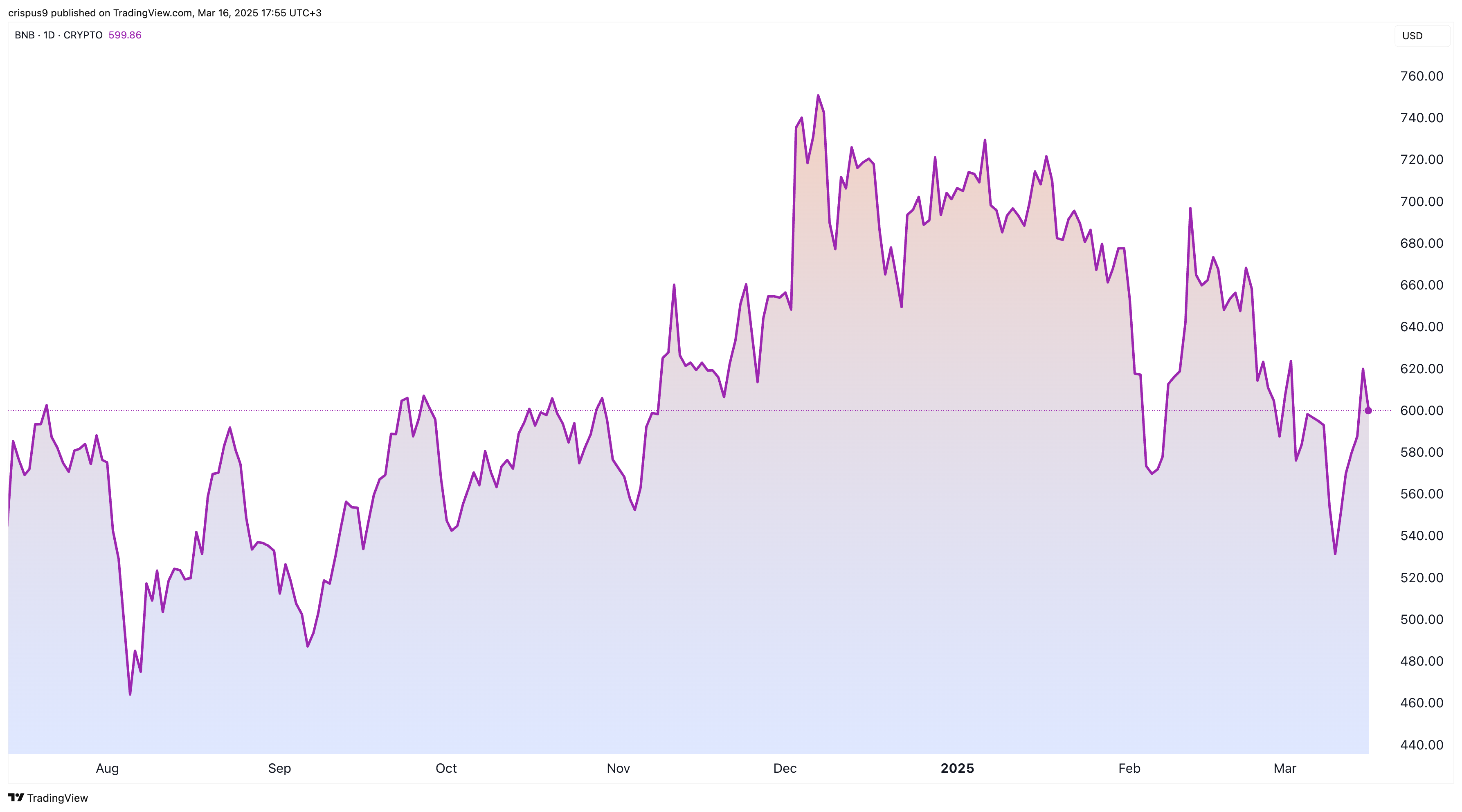

BNB

BNB price will be in the spotlight this week as the developers activate the Pascal hard fork on March 20. This is one of the three upgrades scheduled for the year’s first half. It is set to introduce newer features, including more Ethereum compatibility, native smart contract wallets, and more security.

The other two upgrades will improve BNB Chain’s speed and security. This is happening as the BSC Chain becomes one of the best alternatives to Ethereum (ETH) and Solana (SOL). Ethereum has higher fees and is slow, while the Solana network is highly associated with meme coins.

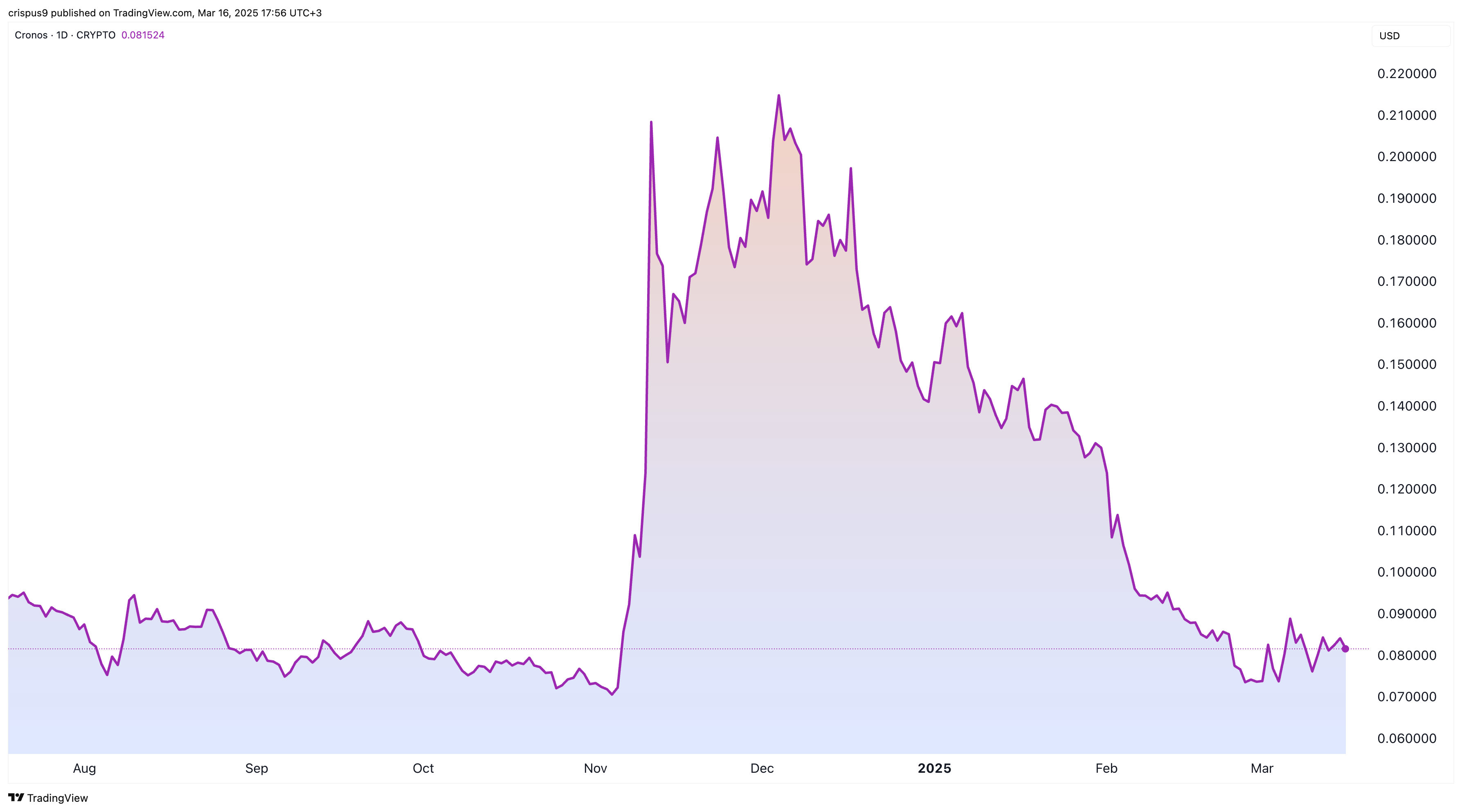

Cronos

A key Cronos vote will conclude on March 17. This crucial vote seeks to determine the creation of the Cronos Strategic Reserve. It aims to do that by undoing a 70 billion token burn that happened in 2021.

If the vote passes, Cronos will create 70 billion tokens and use them to create a reserve that will be used to support the ecosystem. Critics argue that creating these new tokens will dilute existing investors by adding to the supply.

Voting data shows that 45.8% of users have voted in support of the proposal, while 44.4% have rejected it. 9.27% have abstained. If the vote ends like this, the proposal will be rejected as the turnout is less than the quorum.

ZetaChain

ZetaChain is another top cryptocurrency to watch after its price crashed to a record low of $0.2070. It has dropped by over 92% from its all-time high, bringing its market cap to $151 million.

One reason for the ZETA price crash is that the total value locked in its ecosystem has crashed to $13 million from its all-time high of near $20 million.

The other reason is that Zetachain is highly dilutive as it has a circulating supply of 731 million against a total supply of 2.1 billion.

The network will unlock tokens worth over $6.6 million, representing 4.29% of the float this week. Cryptocurrencies are often highly volatile when there is a major unlock.

2025-03-16 15:54:06

#Cryptocurrencies #watch #week #Binance #Coin #Cronos #ZetaChain