Binance Captures 50% of Bitcoin Trading Volume Amid Market Decline

April 17, 2025 – Updated analysis of Binance’s growing market dominance as overall crypto trading volumes decline in Q1 2025.

Key Highlights

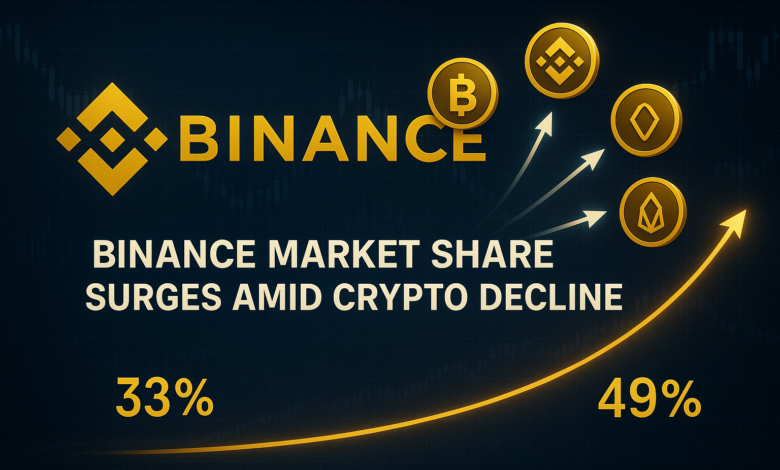

- Binance’s share of total daily Bitcoin spot trading volume jumped from 33% to 49% by the end of Q1 2025

- Overall Bitcoin spot trading volumes declined 77% industry-wide, from $44B to $10B since early February

- Altcoin trading volumes on Binance increased from 38% to 44% market share despite an 80% overall market decline

- Several altcoins including BNB, TON, and EOS maintain high trading activity on Binance’s platform

Binance Emerges as Dominant Trading Venue During Market Correction

Recent data from cryptocurrency analytics firm CryptoQuant reveals a significant shift in trading behavior as Binance has substantially increased its market dominance during a period of declining trading volumes across the industry.

According to CryptoQuant’s comprehensive analysis, total Bitcoin spot trading volume on crypto exchanges has plummeted from a high of $44 billion on February 3 to just $10 billion by the end of Q1 2025 – representing a staggering 77% decline. During the same period, altcoin spot trading volumes experienced an even steeper drop, falling from $122 billion to $23 billion – a reduction of over 80%.

Increasing Market Share During Volatility

The most remarkable aspect of this market shift is that while overall volumes declined substantially, Binance’s proportion of that trading activity grew dramatically. The exchange’s share of daily Bitcoin spot trading volume increased from 33% in early February to 49% by the end of March 2025. Similarly, Binance’s share of altcoin spot trading volume rose from 38% to 44% during the same period.

This trend suggests that as market uncertainty increased and trading volumes dropped, traders consolidated their activity on Binance, indicating a “flight to quality” as users sought the liquidity and security of the largest exchange during volatile market conditions.

Binance Becomes Primary Liquidity Hub During Market Stress

The data becomes particularly telling when examining specific periods of heightened market volatility. For instance, when Bitcoin experienced a sharp correction from $96,000 to $90,000 in late February, Binance’s trading volumes surpassed those of all other exchanges combined. During this period, Binance’s share of altcoin trading volume temporarily spiked to 64%, representing approximately $18 billion in trading activity.

Industry analyst Shaurya Malwa of CoinDesk notes that “a volume drop of such magnitude suggests traders and investors are losing interest or confidence, possibly due to uncertainty, fear, or waiting for better conditions.” However, the concentration of remaining activity on Binance demonstrates the exchange’s critical role as the primary liquidity provider during market stress.

Altcoin Trading Remains Resilient on Binance

Despite the broader slowdown in trading activity, certain altcoins continue to show relatively high trading volumes on Binance. Notably, tokens like BNB (Binance’s native token), TON (Telegram Open Network), and EOS maintain significant trading activity compared to the overall market decline.

This selective resilience in trading volumes for specific tokens underscores Binance’s position as the preferred platform for both mainstream and alternative cryptocurrency trading, even during periods of market contraction.

Bitcoin Inflows to Binance Accelerating

Another noteworthy trend identified by CryptoQuant analyst Martuun is the acceleration of Bitcoin inflows to Binance in recent weeks. According to the data, “The bitcoin reserve on Binance has increased from 568,768 BTC (Mar 28) to 590,874 BTC (Apr 9), an increase of 22,106 BTC.”

This significant increase in Bitcoin reserves on the exchange further validates the notion that investors are actively moving funds to Binance, potentially in preparation for market volatility or in response to broader macroeconomic uncertainty.

Implications for Crypto Traders and Investors

For cryptocurrency traders and investors, Binance’s growing market dominance offers both advantages and considerations:

- Enhanced Liquidity: Greater concentration of trading on a single platform typically results in improved liquidity and tighter spreads, benefiting active traders.

- Institutional Preference: The migration of trading activity to Binance may reflect institutional investors’ preference for platforms with robust infrastructure and security measures.

- Market Impact: With nearly half of all Bitcoin spot trading occurring on a single exchange, price movements on Binance may increasingly influence the broader market.

- Trading Opportunities: The resilience of certain altcoins on Binance could present selective trading opportunities even amidst overall market contraction.

Airdrops Strategy During Market Consolidation

For crypto enthusiasts focusing on maximizing their portfolio through airdrops, Binance’s growing centrality in the trading ecosystem makes it an essential platform to maintain an active presence on. Many emerging projects seek to distribute tokens to established cryptocurrency users, and having an active Binance account with trading history can increase eligibility for valuable airdrops.

To ensure you’re positioned for potential airdrops while navigating the current market conditions, check out our comprehensive Binance airdrop guide for detailed strategies and upcoming opportunities.

FAQ

What is Binance’s current market share in the cryptocurrency exchange industry?

As of October 2023, Binance holds approximately 60% of the global cryptocurrency exchange market share, making it the largest player by trading volume.

How does Binance’s market share compare to its closest competitors?

Binance significantly outpaces its closest competitors, such as Coinbase and Kraken, which account for about 15% and 5% of the market share, respectively, highlighting Binance’s dominance.

What factors contribute to Binance’s leading market share position?

Key factors include a wide range of supported cryptocurrencies, advanced trading features, competitive fee structures, and a strong global presence, attracting both retail and institutional investors.

Conclusion: Binance Cements Position as Market Leader

The latest trading volume data confirms Binance’s position as the undisputed leader in cryptocurrency exchange services, particularly during periods of market uncertainty. While overall trading activity has declined significantly from the peaks of early 2025, Binance has managed to not only maintain but substantially increase its market share.

This trend reflects both the exchange’s operational stability and the cryptocurrency market’s natural tendency toward consolidation during periods of reduced activity. For traders and investors, understanding this dynamic is crucial for developing effective strategies in the current market environment.

New to Binance? Register through our referral link to get started with the world’s leading cryptocurrency exchange.

Sources: Data from CryptoQuant, analysis from CoinDesk, and market insights from Martuun.

2025-04-21 14:42:35

#Binance #Captures #Bitcoin #Trading #Volume #Market #Decline